Whatever the quality of your 401(k) plan, you have a significant amount of control in how it grows over time. You could have the best plan out there and still not see an impressive return if you’re not making wise choices. Likewise, your middle-of-the-road plan could have the funds you need by retirement if you play your cards right.

Of course, you should always vet your 401(k) to ensure you choose the one that will work best for you and give you the highest return. However, you’ll find that your choices, in regards to your retirement savings, will have the most impact.

401k best practices are your financial planner’s top priority. Here are the top 10 dos and don’ts when it comes to saving with your 401k plan.

1. Do consistently check in on your plan.

Autopilot is always easier; we know. But, checking in on your 401(k)’s progress is the surest way to be confident that it’s growing how you’d like. Add a recurring item to your calendar to help remind you to take a second to review your account’s progress.

2. Do increase your contribution, if you can.

When you opened your 401(k) or when you started with your most recent employer, you might have been able to contribute less to your plan than you could now. Assess the percentage you’ve committed to and see if there’s some room to grow.

3. Do take full advantage of your employer-match rate.

If you opt to contribute less than what your employer will match, you’re essentially leaving money on the table. Make sure you’re receiving the full amount because, after all, it’s one of your employee benefits.

Remember that your employer might have a vesting period. This means you might need to stay with them for a specific amount of time before you’re able to take the employer-matched funds with you.

4. Do put a part of each bonus into your account.

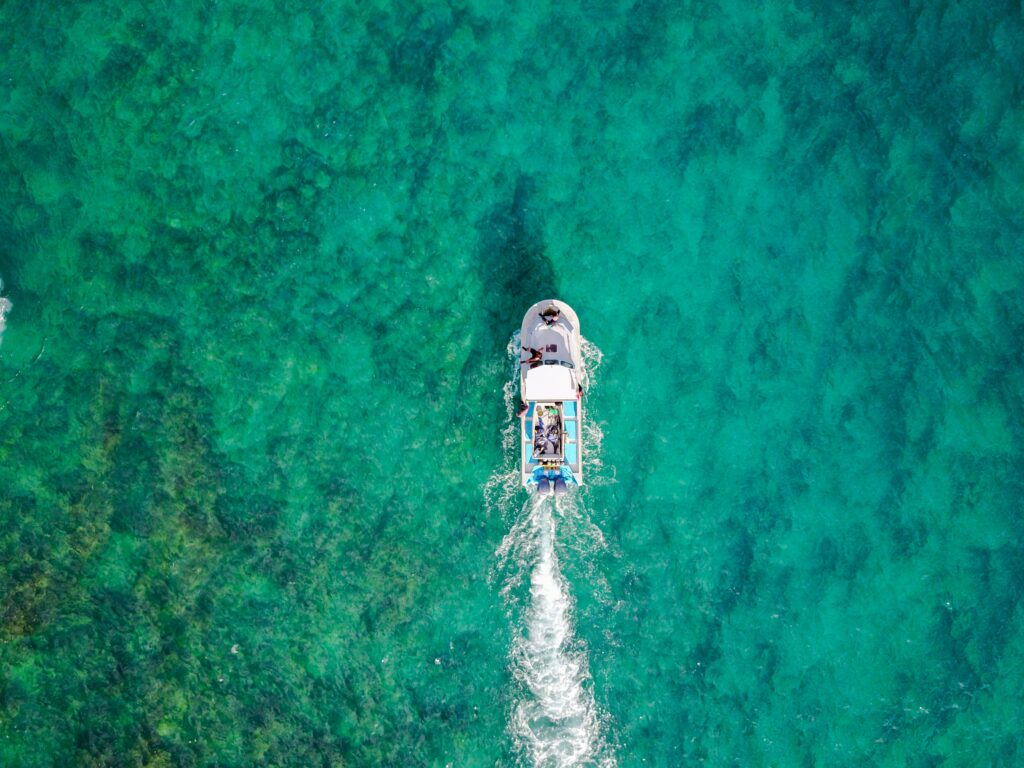

Bonuses are fun to receive and even more fun to spend, but those bonuses will bump up your retirement savings considerably—even if you only contribute a portion. It goes without saying that it would be very beneficial to put the entire amount in your 401(k), but we know you deserve that vacation.

5. Do ask for help if you aren’t sure you’re saving enough.

Financial advisors can help you determine how your 401(k) factors into your overall financial health. They can advise you on which investments to choose and devise a long-term plan that works toward your financial goals.

6. Don’t forget to factor in taxes.

What you see in your account is pre-tax. Remember that when you start withdrawing the money, you will have to pay taxes on it. Be sure you’re saving enough to factor in what you’ll pay in taxes based on your tax bracket.

7. Don’t borrow from your 401(k).

Borrowing from your 401(k) should be your absolute last option. You’ll be hit with a penalty if you’re withdrawing under the age of 59.5, and it will decrease your chances of having sufficient funding for your retirement years. You’ve done so well with your savings. Don’t let a decision like this stifle your progress and set you away from your retirement goal.

8. Don’t cash out if you get a new job.

Instead of cashing out and starting a new plan with your next employer, you can roll your funds. You can choose to roll the funds into an IRA or into your new employer’s plan to avoid early withdrawal penalties.

9. Don’t skip out on the research.

Take the time to explore your options. Is your employer offering you the best possible plan? Maybe. You’ll only know if you get out there and compare. You may need to supplement with additional accounts.

See what’s out there. And, when you have questions on the best way to go, seek out a financial advisor who can help align your choices with your goals.

10. Don’t forget to check out the fees.

Your investment options come with varying amounts of fees. Take care to check the amount on each before you make your decision. Even seemingly small fees can affect your retirement savings in a big way, so be sure you’re getting the best rates.

If you put in the work now, you’ll appreciate the effort when it comes time to use those funds. Financial advisors can help you map out exactly how much you need to save before retirement and what you could be doing now to keep you on track.

Contact Southwestern Investment Group to learn more about how we explore your financial goals and design a holistic strategy to meet them.